Description

What is a Payment Gateway API?

Online businesses are gaining popularity as it’s discovered how much more money can be made. However, accepting money from customers online requires more than just creating a website and selling products. A payment gateway API (Application Programming Interface) can be a valuable tool in this process. A payment gateway API is a software interface that enables businesses to securely and efficiently process transactions. It acts as a bridge between a merchant’s website or application and the payment processor, facilitating online purchases by allowing customers to enter their payment information.

Payment APIs support a range of payment methods, including credit cards, debit cards, and digital wallets, thereby simplifying the overall payment processing process. By facilitating the acceptance of multiple payment types, these APIs enhance customer experience and broaden the scope of acceptable payment methods.

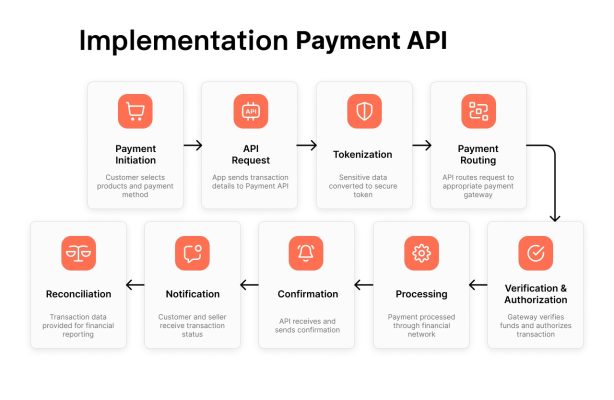

Secure handling of payment details is another critical function of payment APIs. They employ technologies such as tokenization to prevent the disclosure of sensitive payment information, thereby safeguarding customer data and ensuring compliance with security standards. This level of security is paramount for maintaining customer trust and safeguarding against data breaches.

Managing payment status is a crucial feature of payment APIs. They efficiently process transactions, initiate refunds, and handle cancellations, ensuring smooth and transparent payment operations. These capabilities are essential for businesses to maintain accurate financial records and provide exceptional customer service.

What is a payment gateway and how does it work?

Explore the world of payments and gain a deeper understanding of payment gateways. Discover the key factors to consider when choosing a gateway for your business.

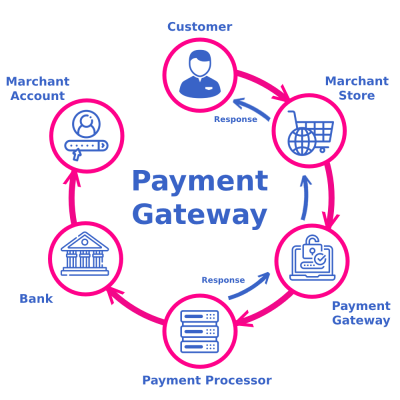

A payment gateway is a service that assists businesses in initiating and accepting payments. It typically connects a business’s website or POS system to a web server, offering various payment channels, including online, in-app, and in-person. Businesses have the option to choose a payment gateway provided by a bank or one from a provider that can connect to one or more payment processors.

Types of payment gateway

Online payment gateways frequently provide services for both websites and applications. While they perform the same function of initiating payments, they may differ in terms of functionalities, features, and supported channels. It is crucial to select a gateway that aligns best with your business’s specific requirements.

For instance, subscription-based businesses frequently require a gateway that supports recurring payments. Software as a Service (SaaS) or marketplace platforms might necessitate a gateway capable of offering embedded payments. Businesses operating in industries such as aviation and gambling may require a high-risk payment gateway with a high-risk tolerance.

Types of Payment APIs

Payment APIs cater to various payment actions, providing businesses and customers with a seamless transaction experience. By accepting payments directly on their websites, businesses can reduce the risk of shopping cart abandonment compared to hosted checkout options. These APIs support multiple payment types, including bank transfers, debit cards, credit cards, ACH, Apple Pay, PayPal, Google Pay, and online payments, offering flexibility and broad acceptance. The ability to connect to multiple gateways enables businesses to easily enter new markets and accept payments from a wider range of customers.

How a payment gateway works

Although payments are completed in seconds, several steps occur in the background. The payment gateway initiates the payment, marking the beginning of the transaction flow.

Benefits of Using Payment APIs

Adopting payment APIs offers numerous benefits for businesses. They enable direct website payments, reducing the risk of shopping cart abandonment compared to hosted checkout options. This facilitates smooth communication between all involved entities as applications can perform both incoming and outgoing payment transactions. Technological advancements in payment APIs focus on enhancing performance, security, and compliance to meet evolving consumer expectations.

Businesses can experience increased transaction speed, reduced processing errors, and operational efficiencies through automation and real-time payments. Additionally, effective management of subscriptions and enhanced financial reporting are significant advantages of using payment APIs. Researching and selecting the right payment API enables businesses to achieve cost-effective solutions and improved decision-making.

How do I choose the right payment API for my business?

To choose the right payment API for your business, evaluate your specific needs, including transaction volume, budget, and international support. Then, research various providers and Prioritising these factors will lead to a more effective payment solution. And let us know which one you want to implement on your websites.

The general process for payment gateway implementation involves these key steps:

Important Considerations during Implementation:

Payment Gateway APIs Implementation demo click here

We deploy your Payment Gateway APIs to your domain or websites!